Welcome back to a new post of “Credit from Macro to Micro”, your guide to navigating the complexities of the bond market.

Today, we're diving deep into a crucial concept often overlooked by investors: convexity. While duration is a widely understood measure of interest rate risk, convexity provides a more nuanced understanding of bond price behavior, particularly for long-maturity securities. This understanding can unlock significant value and enhance portfolio performance.

Duration: A Recap

Before we investigate convexity, let's briefly revisit duration. Duration measures a bond's price sensitivity to interest rate changes. Expressed in years, it approximates the percentage price change for a 1% change in yield. While a valuable tool, duration assumes a linear relationship between bond prices and yields. This is a simplification, and it's where convexity comes in.

The Curvature of Convexity

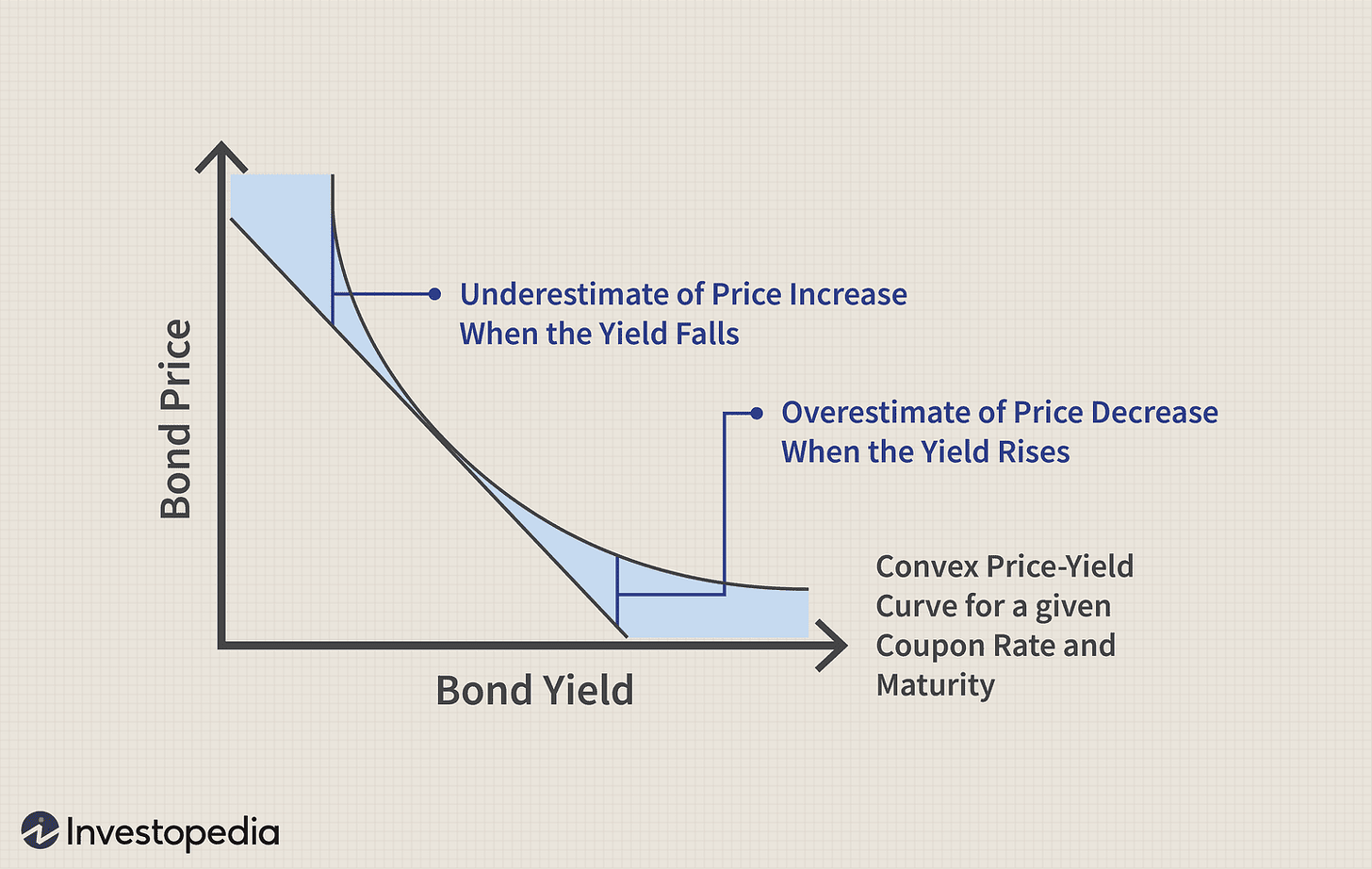

The reality is that the price-yield relationship is curved, not linear. This curvature is what we call convexity. Think of duration as a straight line tangent to the actual price-yield curve. Convexity measures how much the actual curve deviates from that straight line.

This could be important because offers higher upside potential if rates go down vs the price fall in case rates go up (this is what all investors dream: “Asymmetry”, mitigating loss when rates rise.

This effects is particularry important for longer (very longer) maturities bonds, that have high duration, but also high convexity. Below the mathematical effect on bonds.

From a practical point of view, the strategies available to use this effect are various, as a barbell strategy (creating a portfolio of very long and very short duration bonds), or simply a riding the curve strategy (consisting of buying bond with a long duration) and (in normal time) enjoying a roll down effect.