Welcome back at the weekly recap, as usual at the end of the week after one week of rest due to Easter holidays. As always if you like my job/analysis please subscribe below and share it and I remember you that I am also on twitter at @Credit_Junk.

Now let’s see what happened this week!

MACRO/NARRATIVE: This week, in term of data, there was some indication that the hiking cycle of FED (and central banks in general) is having an impact on real economy. The banks crisis (with some failure of small and fragil local banks) was only an alarm bell.

In the USA the weekly jobless claims continued their uptrend and arrived at the highest level since november 2021). Below the initial claims and the continuing one.

The risk is for more pressure going forward looking at some leading indicator of job market (I remember that job market is one of the most laggish indicator). Looking at WARN (Worker Adjustment and Retraining Notification) notices, that must be filed at least 60-90 days before larger firms are planning plant closures or mass layoffs, some more weakness is coming.

Always in the US, we had the April PHILADELPHIA FED FACTORY INDEX -31.3; EST. -19.3. This manufacturing indicator, as the other in the chart below, is a leading indicator of one of the various regional FED. The print totally deny the bounce of the US NY Empire manufacturing we saw last week. We saw a continue downtrend in price paid, but only a small bounce in the new orders components. More attention will be needed for the next reginal surveys.

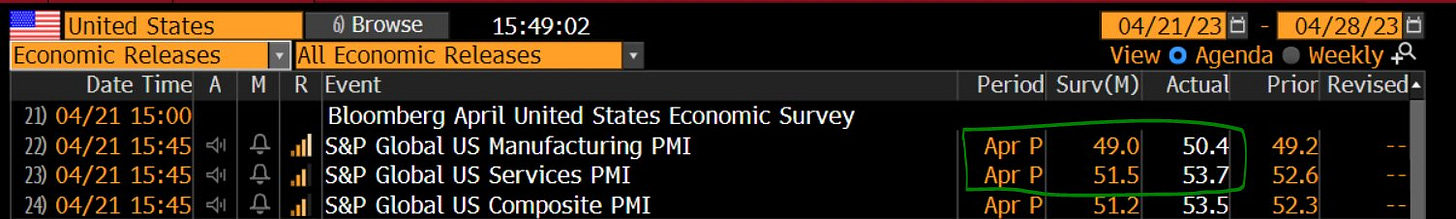

Today, we had the print of the PMI that despite is less important than ISM, is always a market mover.

Both the services and the manufacturing climbed, with firms seeing new orders jump to the highest rate in 11 months, especially in the service sector.

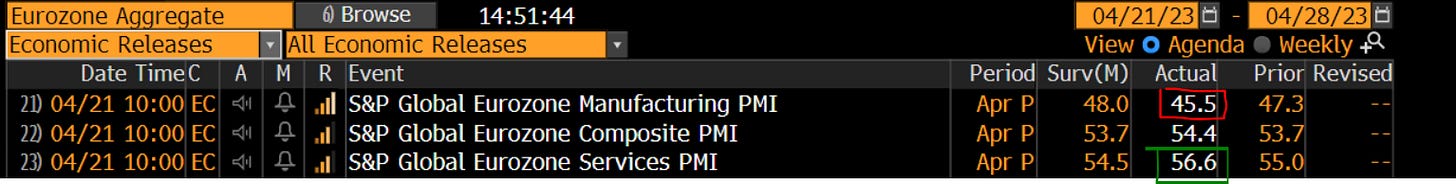

Passing now to Eurozone we had the preliminary PMI for April. The services components rebounded again from 55 to 56.6 (exp. 54.5) while some weakness remains in the manufacturing component.

But the "weakness" in manufacturing need to be taken with a grain of salt due to the improvement (reduction of delivery times). Normally low waiting times = low demand but after the bottleneck of covid something could be different now.

Let's be open minded and follow the data!

Before going ahead I want to suggest you the read of the substack of a friend of mine (Heard on the Trading Floor). Inside you can find a lot of relative value idea regarding equity and credit (especially USD based). Below you can find his last piece:

https://twitter.com/HeardFloor/status/1647972131630723072?s=20

MARKETS:

Rates: Rates continued their normalization path after the bank crisis (with most of the repricing almost done also on risky assets). Terminal rates returned up (with market pricing now 25bp for the next meeting of the FED and a terminal rate of 3.75 for ECB, equal to other 3 hikes of 25bp). But space of policy actions of CB is restricted by the persistence of inflation. Despite the headline indicicators continue to go down (for energy and base effects) the core measures remain high and sticky. Wednesday we had the CPI core in UK remaining at 6.2%, well above expectations.

For this reason the biggest move was on UK gilt while treasury and bund yields moved “only” of 1bp and 3bp. But below the headline number we can break the week in two parts: the first one of rising rates while the second part impacted by the risk off related to Philadelphia FED manufacturing weakness and claims.

Credit: the performance of credit was almost stable with some tightening in the IG cash that followed the fall of government yield.

Thanks to the fall of MOVE (rates volatility) and the positive technicals going into reporting season (low supply) credit are trending tighter and, in some cases (as for the ITRAX Main IG) touching the low of the year).

Remaining always on credit, and returning just for a moment on the weakness of some data, this chart of Simon White (Bloomberg) is very interesting. I said that spread tightened a lot and in some cases is near the tightest level of the year. I am not saying a recession will come tomorrow but in that case HY is the most mispriced asset across the most sensitive to growth risk.

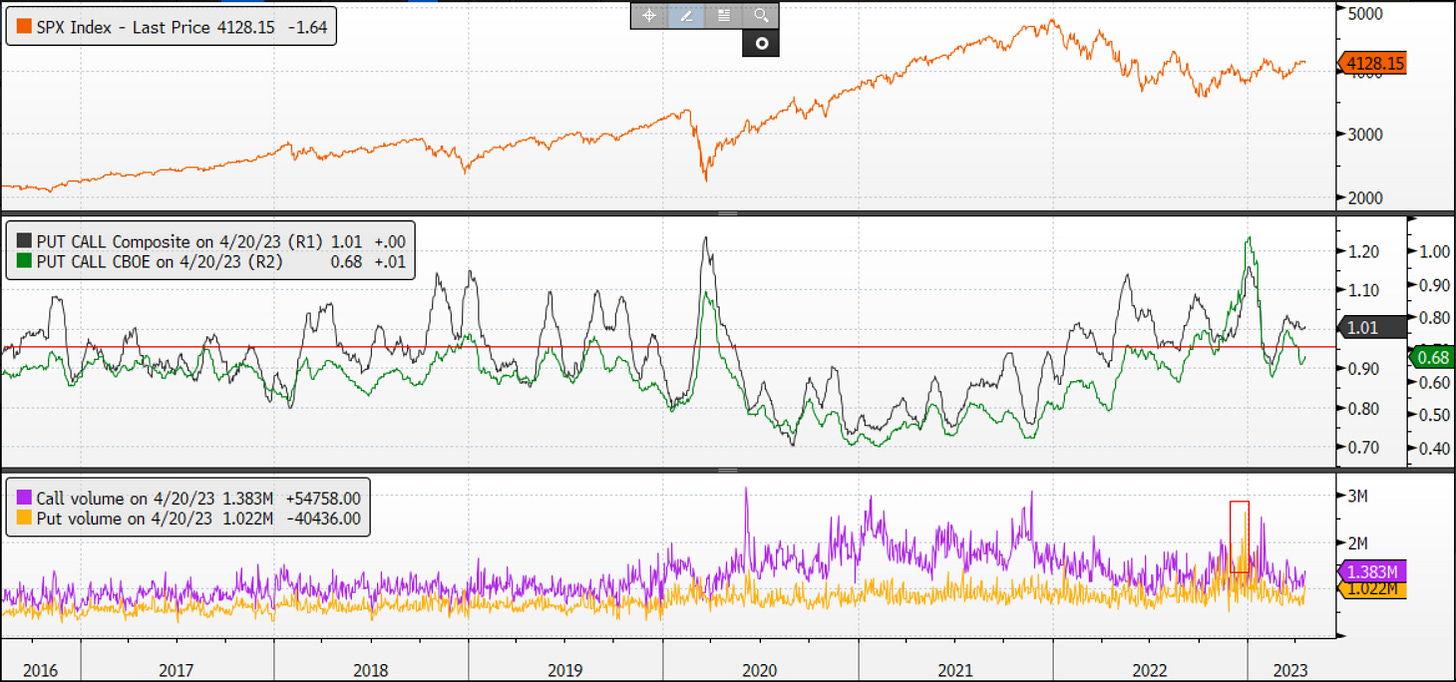

Equity: Volatility remains low and a lot of bet are made now using 0dte (very short maturity options). This is a very technical market. Equity is closing the weekly almost flat in US and EU (SPX -0.19%, SXXP 0.16%).

Looking at the chart of ES1 it’s evident the wall of the level at 4.200 (where the battle between bulls and bears is taking the action). Looking at price action I note the divergence with MACD (that is near a downtrend cross) and RSI.

Returing on options (and the importance of 0dte) I invite you to follow my friend Alessio and Gianluca with their job on gamma, and options profile:

https://twitter.com/MenthorQpro/status/1649370891552161792?s=20

As said different times, one of the factor that support equity market remains, for the moment, liquidity (global central bank liquidity) and positioning/sentiment (all investors entered the year expecting a recession so with a soft positioning) so while the data printed better than expected they started to cover some short positioning or use cash on the sideline.

Looking only at the positioning on futures of the fast money (CTA, hedge-fund, etc) short positioning remains, while that one of real money is now more balanced.

It’s interesting to look also at skew with more traders now buying put protection into the rally, despite the Pu-call ratio is not so streched.

Oil: Just some words regarding oil. After the unexpected OPEC+ cut the price spiked but now due to the growth fears (impacting demand) is returning to point 0, closing the gap. Despite decreasing oil inventories, the demand for diesel/heating oil is decreasing, impacting crack spreads and refining margin.

MICRO: The single name newsflow was low this week entering the reporting seasong but the best performer of the week is:

ADRBID (United Group): bond bounced after the news of a possible (and imminent) deal to sell towers to Saudi Telecom

while the the worst performer is

COFP (Casino CCC-Caa): with Fitch that has lowered the outlook on Casino's rating to negative from positive

For today it’s all. If you liked reading it and want to support my job, please share this piece to friends and colleague and subscribe to the newsletter using the link below.

Have a great weekend,

Credit_Junk