Welcome back at the weekly recap, as usual at the end of the week. As always if you like my job/analysis please subscribe below and share it and I remember you that I am also on twitter at @Credit_Junk. And now let’s see what happened this week.

MACRO/NARRATIVE: during the week we had a series of economic prints that confirmed the weakness in macro momentum like the US PMI for November (below 50 and decreasing for both services and manufacturing).

If we want to look also at more forward looking indicators (that try to anticipate the next months prints for ISM for example) the orders to inventories ratio and the expectation for the orders for the next 6 months (calculated by Philadelphia FED) both show an ISM that could go down near the 40/45 area, so a true recession is expected in the second half of 2023.

The same leading indicator for Eurozone, despite being always below 50 (a theshold that indicate a period of growth vs one of contraction) was better than feared, thanks to a reduction in delivery time and of the supply chain problems.

Two events/narrative are noteworthy:

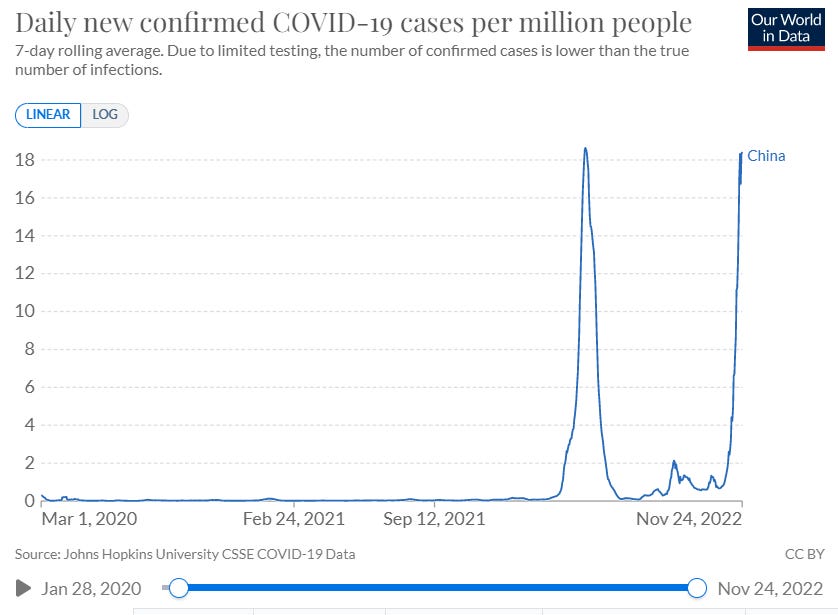

the rapid rise of covid cases in China. This is a true problem considering that the country has a very low vaccinations rate (especially in the older people) they need to use a 0-covid policy. In fact several areas of the country are now in lockdown again (also Beijing). Unrests are rising because people can't take it anymore after more than 2 years (https://www.bbc.com/news/world-asia-china-63725812). My hypothesis is that due to the fact they have a fase 3 domestic Mrna vaccine, and due to the high cost of frequent covid test in 6 months they’ll try to partially reopen, using the chinese vaccine as an internal propaganda.

FOMC minutes: FED published the minutes of the October meeting that confirmed that most governors see a downshift from 75 to 50bp in next meeting to better value the effect of the cumulative rates hike and the effect on the economy due the the lag effect of the increases. The other point was that various members see also that the peak rate is higher than before due to the persistence of core inflation and the possible risk of wages-prices spiral.

MARKETS:

Rates: a mix of weak macro data and the investors confort central banks are ready to slow down the hiking path created a perfect environment for investing in duration and government bonds, especially after the soft print in US CPI and PPI we saw in the past weeks. Nominal rates in US and Germany turned down (to 3.60% for treasury and 1.87% for bund) and curve continue do flat and invert.

Rates usually peak 1-3 months before the last hike and usually start to perform when markets smell the first cut. Also the curve (below from a SG research) start to react as a late cycle with short term continue to flatten until (2-5) or later (1-2) the last hike, while the long end end (5-10, 10-30 begin to steep also before the last hike). So in this environment the belly of the curve (5y area) is interesting versus the wings.

Below a trade that I like at the moment is a long 2/5/30, expecting a continuing flattening of the 2-5 curve (here I speak of the german curve) and a convergence of the fly with the curve (outperformance of the body 5Y).

Credit: A more clarity over the peak in interest rates have helped both equities and credit. In fact IG tightened 5bp in euro area, while HY of 25bp. The same magnitude is visible in CDS, ETF and BTP-bund too (gone to 180bp).

But below the surface of the la-la-land in credit market the CCC vs B (the weakest part of credit spectrum) is widening YTD and there is a evident divergence in this internal indicator vs the broad HY market. Weak growth ahead and higher rates will impact lower rating, so pay attention on this (give credit to credit) and stay defensive with a preference on IG vs HY.

Equity: the same divergence is evident in equity too where the ratio of cyclical vs defensive stopped to bounce and returned to go down. The best economist is inside the market, said Stanley Druckenmiller, that affirmed that the bounce reduce the recession risk in the short term but the underperformance YTD, together with the signal coming from yield curve and I’ll add also the “internal of credit CCC-B) call for caution.

FX: on FX the most important aspect to comment is the fall in dollar. This is very important for global liquidity consideration given the fact that the dollar is the global currency. A peak in rate expectations is what has driven this. I wrote a thread on this argument that you can see below. But not all currency are created equal so, while some safe currency could be considered against the dollar now (maybe CHF or JPY) other will continue to suffer due to internal weakness (like EUR).

MICRO: passing now at winners and losers we have also reporting season that continue to move single name bonds and stories:

SFRFP: despite weak/neutral reporting they potential asset sales headlines boosted (some data centers with a value of 1bln) the bond this week.

ELIOR: up with the story of a possible tieup with Derichebourg (not all the company but regarding some assets/sectors)

FOOBON: reported results today, but the market mover today was the fact that Telepizza (a brand of Food Delivery) hired Houlihan to restructure debt

It’s all for today. I hope you enjoyed my job/analysis. Feel free to forward it to friends/colleague and remember to subscribe to the newsletter.